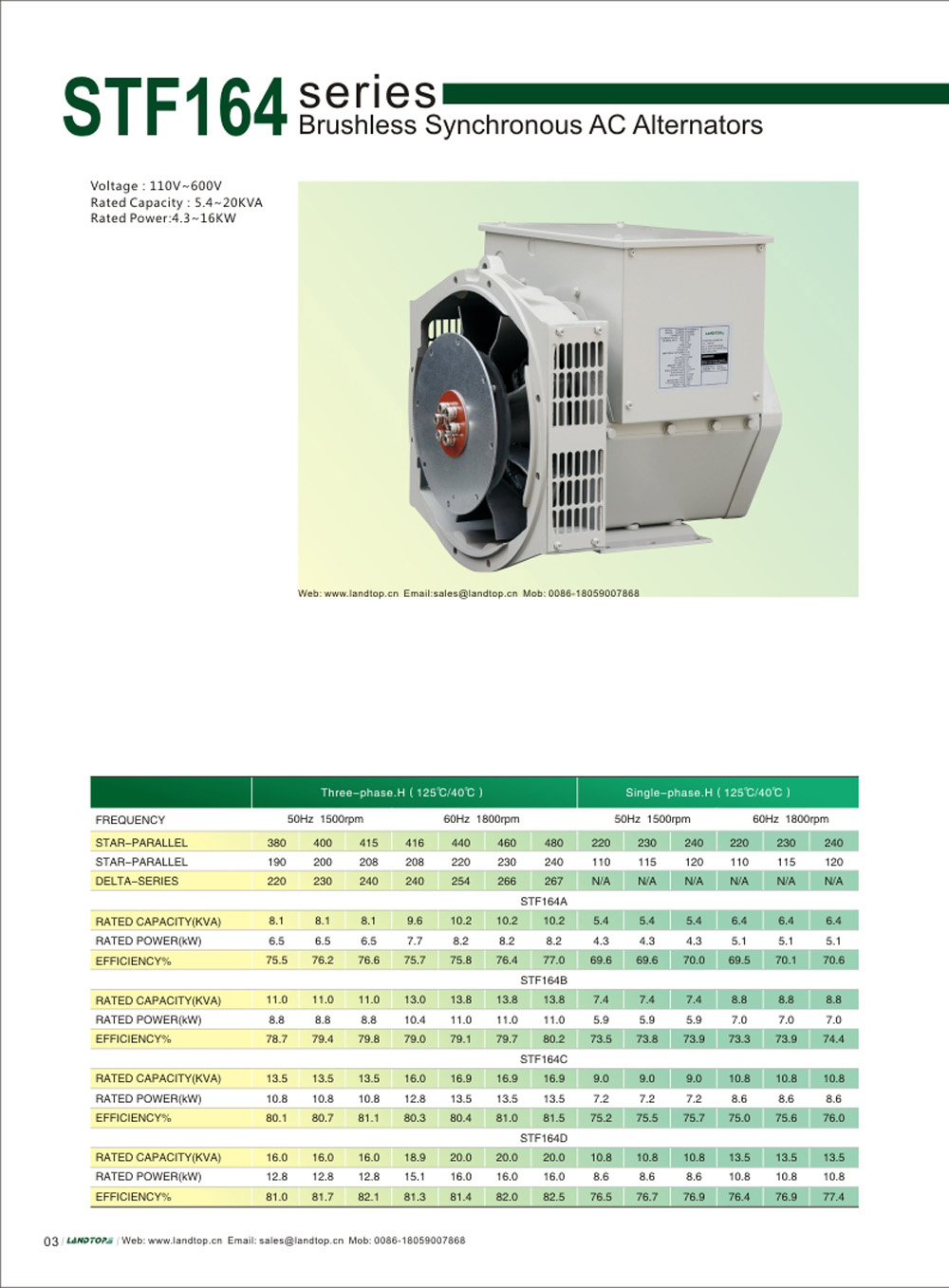

Artificial intelligence is changing people's lives, from intelligent networked cars to intelligent service robots, from smart drones to medical image-assisted diagnostic systems, from smart home life to auto insurance damages... Widespread adoption of AI technology is being driven by society. More attention. Take automobile damage control as an example. At present, automobiles have become popular. However, when accidents or injuries occur in vehicles, insurance application claims services generally suffer from problems such as slow loss and difficult loans, and are criticized by consumers. The traditional claims process involves too many subjects, and it is not only a cumbersome process, but also a long time cycle, from the damage to settlement and settlement of funds. However, for these pain points, smart damages came into being. It is understood that insurance companies and related technology companies are making efforts from the technology side, based on deep learning of image recognition detection technology, using AI as the examiner's eyes and brain, using scientific and technological means to assess accident damage and provide claims solutions. Second-order damage does not delay artificial intelligence to break the pain point First of all, the driver is also a damage controller and the second-level damages are not delayed. The owner only needs to upload the photo of the accident through the smart loss app. After the algorithm identifies the accident photo, it can give an accurate result of the damage within a few seconds, including the damaged parts, the maintenance plan and the maintenance price. Even given the nearest repair shop address and maintenance quote. If the owner agrees, it can even pay the amount of the payment to the owner’s account instantly to achieve the effect of the second payment. Second, car owners get the best choice and maximize their rights and interests. Not only does the intelligent damage control allow the owner to quickly obtain claims, but it also allows the owner to make the best choice for him. If there is a collision on the road, the guilty party may upload the photos of the two vehicles to the insurance company using the Smart Loss App. After knowing the amount of the compensation immediately, they can also see the amount of premium for the subsequent year of application for compensation, under the condition of a comparative difference. The owner can get the best choice and promote his own rights and interests to get the maximum of the economy. Reduce insurance costs to avoid auto insurance fraud According to the data of China Insurance Regulatory Commission, the premium income of property insurance (including motor insurance, agricultural insurance and other types of insurance) was nearly trillion yuan in 2017, while auto insurance accounted for about 70% of the property insurance premium income, and other insurance (including property insurance, credit guarantee insurance, agriculture Insurance, liability insurance, accident insurance, and health insurance accounted for about 30% of total revenue. From this, it can be estimated that the current auto insurance market space is about 700 billion. Loss determination is one of the most important operational links in automobile insurance claims. Most of the previous manual damages were determined by the vehicle as a basis for claims, and processes such as claims and verification often required more time. The huge manpower burden and the opaque risk in the process of loss determination have become an unbearable burden for the auto insurance business of insurance companies. To reduce the overall cost ratio of insurance companies, it is an effective measure to increase the application of science and technology. According to industry insiders, the use of AI technology to transform the traditional auto insurance risk-restructuring link will have obvious benefits for auto insurance companies: First, it can save case processing costs: At present, about 100,000 people are engaged in surveying and approving damages, and the country is roughly 4,500 annually. In the case of private car insurance claims, the proportion of cases with pure appearance damage is about 60%, and the average processing cost per case requires 200 yuan, and the annual handling cost of the case exceeds 5 billion. It is understood that the current intelligent damage control can achieve more than 90% of automatic adjustment cases. The second is that intelligent damage control can effectively achieve anti-leakage and anti-fraud. According to statistics, at present, China’s auto insurance claims payouts are roughly 20 million yuan each year. The expenses incurred by auto insurance fraud account for 15%-20% of the insurance company’s expenses, and the total amount exceeds 30 billion yuan. The traditional auto insurance fraud prevention work is done manually. The auditor needs to review dozens of hundreds of claims cases during working hours. The auto parts involved in the cases are hundreds of thousands. The staff must rely on their accumulated experience to find hidden risks. Great workload. The intelligent damage control system converts the experience of the auto insurance auditor into an internal rule engine. The vehicle's collision logic and accessories' attributes, such as regular and mechanical information, are passed to the intelligent damage control, which can greatly improve the anti-fraud recognition rate of the insurance company. On the other hand, intelligent damage control can also eliminate the tricky behavior between the damage controller and the 4S or repair shop, and further protect the interests of insurance companies and car owners. Giant layout smart loss of market technology to help speed up competition The data shows that in the entire auto insurance market, the proportion of people's insurance is 35%; Ping An's share is 22%; the total share exceeds 50%; in the face of the broad market prospects of smart loss, the two giants are also laying out. Ping An Insurance may be the earliest research and development of smart loss management, and it has already applied the technology developed by its technology companies to its business. According to Ping An Insurance, only in 2017, smart loss-making technology will bring more than 8 billion yuan of revenue to Ping An Property & Casualty, reducing 30% of audit manpower. Through the intelligent image damage application + digital anti-leakage rule, 99.7% of the automatic tuning cases were achieved, and the speed of the damage was increased by 4,000 times. In February 2018, PICC announced that its intelligent damage control system developed by ArcSoft has been put into use. Relevant person in charge claimed that PICC will expand its auto insurance and health insurance channels in three directions: First, take the traffic platform as an entry point to speed up the ABC layout of auto insurance—A-side solves the problem of commission commission settlement and online quotation; Small B scene, to enhance sales coverage; P2P intelligent innovation automobile insurance with C-side social + smart damage-reduction + block chain line will use the latest technological process including blockchain and small car insurance process. It is worth noting that insurers are struggling to develop their own intelligent loss-determining technology through collaborative research or co-operation. Financial technology companies are also eyeing this huge market. Through their own research and development of intelligent damage-recovery systems, they can freely grant energy to small and medium-sized insurance companies. A way to preempt users. In fact, Ant Financial launched the smart damage control system as early as June 2017 targeting small and medium-sized insurance companies. From this point of view, Ant Financial has spotted the opportunity that small and medium-sized insurance companies are eager to improve their service capabilities through science and technology, and hopes to use technological output to enter the insurance business. It is wise for Ant Financial to adopt a long-term strategy for free use by insurers. On the one hand, whether the entire system developed outside the industry can meet the needs of the industry can only be verified in a formal scenario. To allow small and medium-sized insurance companies to use them without barriers, in the entire process, they can continuously improve the optimization system so as to avoid closed doors and build more competitive products. On the other hand, when an insurance company accesses the system, it can obtain a large amount of insurance industry related data, even important information including customer information, so as to better understand the rules of the insurance industry and gain more business opportunities. STF164 Series Alternator Suppliers

selected pole and tooth designs, ensures very low waveform distortion.

STF164 Series Copy Stamford Brushless Alternator Copy Stamford Brushless Alternator,Three Phase Brushless Alternator,15 Kva Generator 3 Phase,11 Kva Alternator FUZHOU LANDTOP CO., LTD , https://www.landtopco.com

The insulation system is class 'H'.

All wound components are impregnated with materials and processes designed specifically to provide the high build

required for static windings and the high mechanical strength required for rotating components.

WINDINGS & ELECTRICAL PERFORMANCE

All generator stators are wound to 2/3 pitch. This eliminates triple (3rd,9th,15th) harmonics on the voltage waveform

and is found to be the optimum design for trouble-free supply of non-linear loads. The 2/3 pitch design avoids

excessive neutral currents sometimes seen with higher winding pitches, when in parallel with the mains. A fully

connected damper winding reduces oscillations during paralleling. This winding, with the 2/3 pitch and carefully